The sooner you act, the sooner you’ll see the benefits, and here are six things you can work on today.

Credit score not looking as peachy as you’d like? Whether you’re hoping to secure a mortgage or you’ve got your eye on a big-ticket item you’d like to buy with credit, you probably want to know if there’s anything you can do to improve your score, ASAP.

Well, you’re in luck. In this article, we’ll give you some top tips on how to spruce up your credit score in as little as 30 days.

Let’s get stuck in with six things that affect your credit score, how much changing them could boost your number by, and what you can do about it today.

Scroll down to see our handy points table for all the actions we're covering.

1. Credit card utilisation rate

It sounds a bit baffling and technical, but all it means is the percentage of credit available to you that you actually use. So let’s say your credit card limit’s £3,000, if your balance is £1,500 your utilisation rate would be 50%, because you’ve only used half of what’s available to you.

To have a positive impact on your credit score, the ideal utilisation rate is 30% or less. So, sticking with the same example, you wouldn’t want your outstanding balance to be more than £900, because that’s 30% of £3,000.

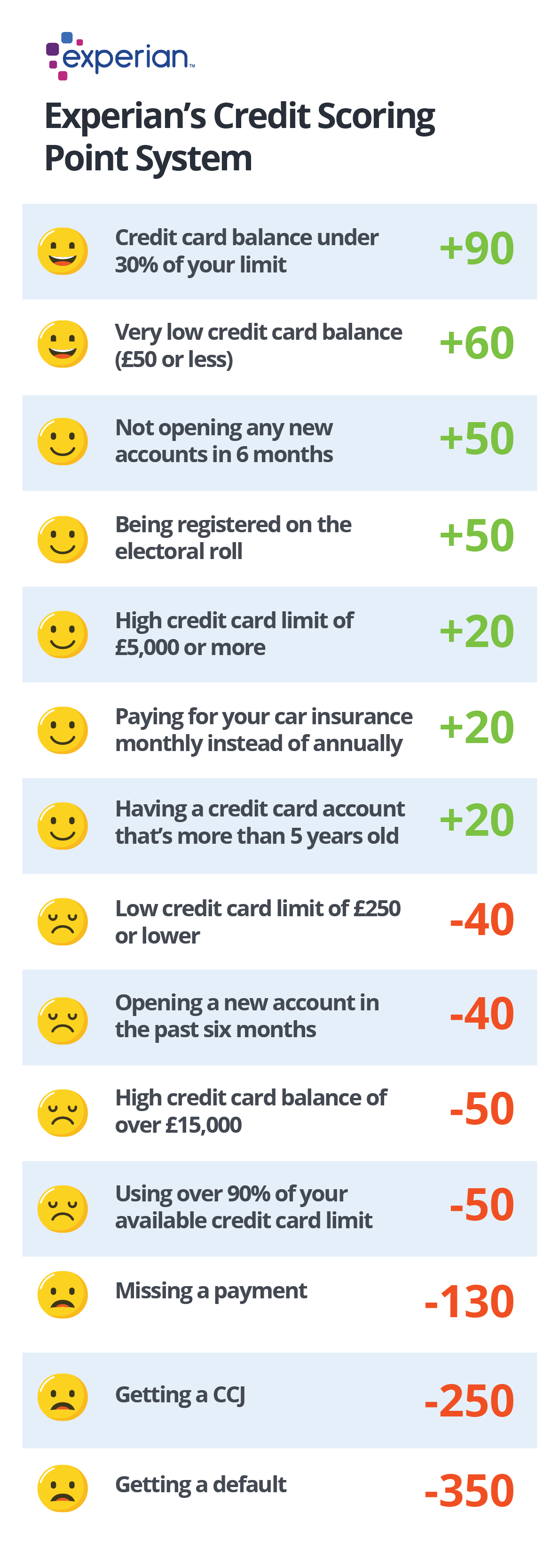

Proof: You can be rewarded with 90 extra points on your credit score for having a credit card utilisation under 30%.

What you can do:

To improve your utilisation rate quickly you can:

- Pay more than the minimum each month

- Ask for a credit limit increase (be aware that this may mean a credit check)

- Refinance credit card debt with a loan

2. Credit card balance

This sounds like the same thing as above, but stick with us. While the two go hand-in-hand, you can boost your credit score even more by keeping your credit card balance as low as possible.

So while keeping below 30% will up your rating, getting your balance to £50 or less will push you up even further.

Proof: Your credit score would benefit by another 60 points if your credit card balance is £50 or less with Experian.

What you can do: Simply follow the steps we gave to improve your credit utilisation ratio.

3. The electoral roll

In a nutshell, make sure you’re registered on it.

When a potential lender’s making their decision on whether or not to accept your application for credit, they’ll run some background checks and when you register to vote, your electoral details appear on your credit report. If you’ve done it, lenders can quickly and easily see you are who you say you are.

Proof: With Experian, being registered on the electoral roll will bag you 50 credit score points.

What you can do: Registering on the electoral roll is super quick and easy and you can do it here.

4. High credit card limit

Yep, we’re back on credit cards. But this time, it’s all about your credit limit e.g. how much you’re allowed to spend.

When you first opened your credit card account you might have been given a credit limit of £500-£1,000, but if you’ve demonstrated you’re good with money (i.e. paid off at least your minimum balance each month) you’re credit limit may have crept up, without you even asking (depending on the account).

For this reason, having a high credit limit shows lenders you’re good with money and are likely to be a trustworthy applicant.

Proof: A credit card limit of £5,000 or more will top up your score by 20 points with Experian.

What you can do: Besides paying your monthly minimum payments and hoping your lender notices and ups your limit, there’s nothing stopping you asking for an increase yourself.

5. Pay for car insurance monthly

Why? We hear you cry. Surely being able to afford it in one go is preferable? Nope, finance is a funny old world.

Building a history of timely repayments is one of the best ways to improve your rating, and paying your car insurance bill with your credit card each month is one way to go about doing just that.

Proof: Paying for your car insurance monthly instead of annually will bank you 20 credit score points with (you guessed it) Experian.

What you can do: We don’t want to state the obvious but… opt to pay your car insurance monthly.

6. Check for mistakes

It’s always important to check your credit report for any mistakes. There are plenty of companies who offer you free access to your credit report, like Experian, Equifax and Intuit Credit Karma, so don’t be tricked into paying to see it.

Errors in your report could be negatively impacting on your score, so it’s important to be extra vigilant.

Proof: We can’t really tell you how much your score will increase by as it depends totally on the nature and magnitude of the mistake, but the bigger the blunder the more points you could recoup.

What you can do: If you think there’s something wrong that could be affecting your score, get in touch with the credit reference agency and dispute the error. Once you’ve raised a dispute two things will happen:,

a) The bureau must review all the information and documents and notify the business who provided the information.

b) The payment history and balance it relates to will not be considered during this dispute period .

Basically, that means they can’t impact your score until an investigation’s completed (generally this is about 30 days).

How many points will I gain?

These figures are sourced from Debt Camel and This is Money, and are to be used as a guideline only. Experian’s points system can vary from person to person.

How long will it take for my score to improve?

How long is a piece of string? Not helpful, we know, but the answer really depends on which of the points we’re talking about.

Take registering on the electoral roll for example, once you’re registered your local authority will pass the information on to the credit reference agencies and this usually happens once a month - so within 30 days would be a reasonable estimation.

When it comes to information relating to your bank accounts and credit cards, Experian advise it can take up to three months to reach them and have any impact on your credit score.

Repaying your car insurance monthly, on the other hand, should have a much quicker effect because lenders report installment loan activity to credit reporting agencies once a month.

Want more information?

For more on improving your credit score in general this is the place to be.

Disclaimer: We make every effort to ensure that content is correct at the time of publication. Please note that information published on this website does not constitute financial advice, and we aren’t responsible for the content of any external sites.