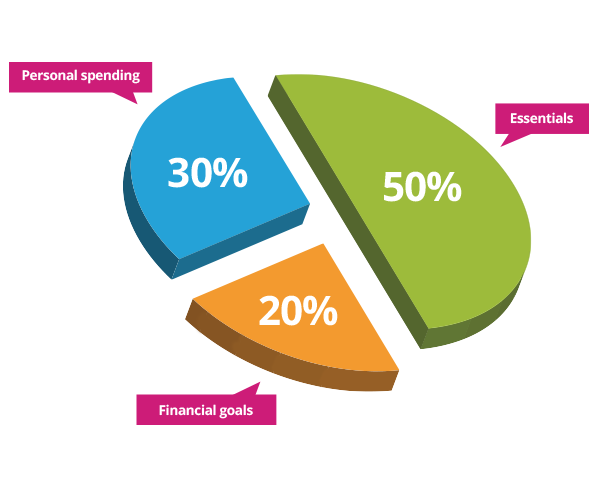

Forget complicated spreadsheets, endless calculations and confusing figures… the 50-20-30 financial rule simplifies things and actually works!

We understand how overwhelming the thought of budgeting can be. Trying to figure out how much you need for your utilities, transportation costs, mobile phone, property payments, food… it’s too difficult! And then what about money for leisure activities, such as eating out and going to the cinema…?

The 50-20-30 financial rule scraps all the drama, and makes money management easy. So what do the numbers stand for? It’s how you should split your income.

50% for essentials

This is allocated for all those necessary bills that you pay each month. These are the things you can’t go without – such as housing, food, transport and utilities. It doesn’t include that coffee you enjoy before work, or the chocolate cake you can’t resist in the supermarket!

50% may seem like a huge chunk of your salary, but there are a lot of outgoings that rely on this money. Not only that, they’re the most important payments, as they keep the roof over your head and the food on the table.

So, if you earn £1,500 a month after tax, you should try to put aside £750 for your essential bills.

20% for financial goals

Whether you want to pay down your debt or build your savings account, it’s recommended to put 20% of your monthly wage towards this.

Both of these are great goals to aim for. The quicker you can pay off your debt, the less interest you’ll pay – therefore saving you money. Plus, by paying it off on time, you’ll improve your credit score as it shows you can manage money responsibly.

A healthy savings pot is crucial for future security and safety – as it’s impossible to predict every expenditure. What if you lost your job tomorrow? What if your freezer stopped working? How would you pay for it? That’s where your emergency fund comes in!

So, if you earn £1,500 a month after tax, you should aim to put £300 towards your financial goals.

30% for personal spending

Personal spending is for the things you want, not necessarily need. However, before you get spend-happy, you probably use a good chunk of this percentage already.

This section includes your mobile phone contract, your monthly TV subscription, going for coffee, and that new piece of clothing you ‘needed’ for a night out. You might have to be strict with yourself and make slight lifestyle changes in order to stick to the allocated 30%.

If you earn £1,500 a month after tax, you’ll have £450 for personal spending.

Obviously, this is just a guide and it might require some adjustment depending on your lifestyle. For example, if you live in London, you might find yourself spending more than 50% on essentials due to the higher cost of living. Or if you live in the countryside, you may have more money to put towards your savings.

Tip: To help you manage your budget more effectively, you could split your money between three different accounts. Schedule all your Direct Debits out of one, put your savings in another, and the rest is your spends for the month. By doing this, your budget is clear and easy to stick to.

Disclaimer: We make every effort to ensure that content is correct at the time of publication. Please note that information published on this website does not constitute financial advice, and we aren’t responsible for the content of any external sites.